Surajit

Mazumdar

Mazumdar

This is a follow up of the previous article published by Vikalp “Demonetization:

Beyond the Hype”

Beyond the Hype”

With over a month having passed since the old rupee 500 and

1000 denomination notes were put out of circulation, the adverse effects of the

demonetization measure on economic activity, employment and income generation

have become visible and are there for everyone to see. The assertion that the

measure would nevertheless imply a drastic hit on the black economy has also

come under increasing scrutiny. However, this perception may not have been

fully dispelled yet. Let us therefore scrutinize it, and with the help of some

numbers.

1000 denomination notes were put out of circulation, the adverse effects of the

demonetization measure on economic activity, employment and income generation

have become visible and are there for everyone to see. The assertion that the

measure would nevertheless imply a drastic hit on the black economy has also

come under increasing scrutiny. However, this perception may not have been

fully dispelled yet. Let us therefore scrutinize it, and with the help of some

numbers.

I

While we are used to distinguishing the rich and the poor,

those with high and low incomes respectively, in terms of the amount of money

they supposedly possess, money and income are not the same thing. Income is

generated in production and the aggregate of the annual value addition in all

production activities of a country’s economy (adjusted for income flows that

may take place in either direction between the country and the rest of the

world) constitutes what is called the country’s annual national income.

Everyone in the economy who receives any income during the year, and in any

form, receives some fraction of that income, and this includes the taxes that

accrue to the government. The level of each one’s income, and of all of them

together, is determined by the quantity of products (goods or services) that

can be commanded by them and not by the money value of that income.

those with high and low incomes respectively, in terms of the amount of money

they supposedly possess, money and income are not the same thing. Income is

generated in production and the aggregate of the annual value addition in all

production activities of a country’s economy (adjusted for income flows that

may take place in either direction between the country and the rest of the

world) constitutes what is called the country’s annual national income.

Everyone in the economy who receives any income during the year, and in any

form, receives some fraction of that income, and this includes the taxes that

accrue to the government. The level of each one’s income, and of all of them

together, is determined by the quantity of products (goods or services) that

can be commanded by them and not by the money value of that income.

The only difference between black and white income is that

black incomes involve some illegality – they may be generated in economic

activities which the law terms as illegal (e.g. the production of narcotics);

they may be incomes illegally transferred from one party to another (e.g.

bribes); and they may be incomes generated in even legitimate activity which

are hidden from the authorities to avoid paying the taxes the law prescribes.

In a capitalist economy, where money-making is the norm and a driving

motivation in economic activity and yet laws putting some curbs on that

motivation and the taxing incomes are necessary, the tendency for generation of

black incomes always exists. Moreover, since black income earners could use

such incomes to influence both what the law is as well as the degree and nature

of its enforcement, the dividing line between black and white incomes is always

a blurred one. Thus, if some people don’t pay taxes at the prescribed rate and

use part of the gains so made to bribe those entrusted with the responsibility

to enforce those rates, the situation is not fundamentally different from

paying bribes out of gains made to those fixing the rates to get the prescribed

rates themselves lowered. The objectives of lowering of tax rates or creating

loopholes in the tax laws which can be exploited to avoid taxes, thus

converting what might have been black into white, can also be achieved through

influences other than those working through bribes.

black incomes involve some illegality – they may be generated in economic

activities which the law terms as illegal (e.g. the production of narcotics);

they may be incomes illegally transferred from one party to another (e.g.

bribes); and they may be incomes generated in even legitimate activity which

are hidden from the authorities to avoid paying the taxes the law prescribes.

In a capitalist economy, where money-making is the norm and a driving

motivation in economic activity and yet laws putting some curbs on that

motivation and the taxing incomes are necessary, the tendency for generation of

black incomes always exists. Moreover, since black income earners could use

such incomes to influence both what the law is as well as the degree and nature

of its enforcement, the dividing line between black and white incomes is always

a blurred one. Thus, if some people don’t pay taxes at the prescribed rate and

use part of the gains so made to bribe those entrusted with the responsibility

to enforce those rates, the situation is not fundamentally different from

paying bribes out of gains made to those fixing the rates to get the prescribed

rates themselves lowered. The objectives of lowering of tax rates or creating

loopholes in the tax laws which can be exploited to avoid taxes, thus

converting what might have been black into white, can also be achieved through

influences other than those working through bribes.

In the process of producing products, distributing the

income generated through them and the spending of that income – several

transactions are involved in which ‘money’ is used. Every production unit does

not itself produce every input or equipment that it uses – it acquires them

from other producing units and it is in this process that it uses money. Similarly,

every individual deriving an income from a specific production unit does not

only use the products from whose production that income is generated. Instead

that income is used to purchase products produced by many other units and in

this process again money is used. Thus, all producing units buying inputs and

equipment and all individuals spending their incomes together buy in exchange

for money over a given period what all producing units together sell in

exchange for money over the same period. It is because all the selling of

products is in exchange for money that the receipt of income can also be in the

form of money. The total national income or any individual’s income does not

change because of these exchanges. The products whose production generated that

income are simply redistributed among the producing units and individuals

through these transactions. What money does is to convert what would otherwise

be a direct exchange of product for product into two separate transactions – product

for money and money for product. Money is that commodity in terms of which the

value of everything is represented and which can be used to purchase anything

(or be received by selling anything).

income generated through them and the spending of that income – several

transactions are involved in which ‘money’ is used. Every production unit does

not itself produce every input or equipment that it uses – it acquires them

from other producing units and it is in this process that it uses money. Similarly,

every individual deriving an income from a specific production unit does not

only use the products from whose production that income is generated. Instead

that income is used to purchase products produced by many other units and in

this process again money is used. Thus, all producing units buying inputs and

equipment and all individuals spending their incomes together buy in exchange

for money over a given period what all producing units together sell in

exchange for money over the same period. It is because all the selling of

products is in exchange for money that the receipt of income can also be in the

form of money. The total national income or any individual’s income does not

change because of these exchanges. The products whose production generated that

income are simply redistributed among the producing units and individuals

through these transactions. What money does is to convert what would otherwise

be a direct exchange of product for product into two separate transactions – product

for money and money for product. Money is that commodity in terms of which the

value of everything is represented and which can be used to purchase anything

(or be received by selling anything).

Currency with legal tender status is one kind of such money

currently in use – it is money because the law says it is so and whose

components (notes and coins) can be produced at a lower cost than their value

as money. If such currency is freely transferable into and out of deposit

accounts held in banks, then it also becomes possible for payments of ‘money’ to

be made by using those accounts without actually withdrawing currency – by

simply recording the transfer of the value equivalent to a certain amount of

currency, or the right to ‘withdraw’ that much currency, from the deposit

account of the one paying to that of the one receiving. This is the basis for

all that are called ‘cashless’ modes of payment.

currently in use – it is money because the law says it is so and whose

components (notes and coins) can be produced at a lower cost than their value

as money. If such currency is freely transferable into and out of deposit

accounts held in banks, then it also becomes possible for payments of ‘money’ to

be made by using those accounts without actually withdrawing currency – by

simply recording the transfer of the value equivalent to a certain amount of

currency, or the right to ‘withdraw’ that much currency, from the deposit

account of the one paying to that of the one receiving. This is the basis for

all that are called ‘cashless’ modes of payment.

Whichever the kind of money in use, and whatever is the kind

of income generated, the use of money involves it continuously changing hands –

passing from one party to another every time there is a transaction. This

movement of money from one hand to another happens recurrently and every unit of

money is used repeatedly in several transactions. What someone receives as

money is what another spends or lends and what anyone spends is what has been

received from sale or borrowing. In between receiving and spending, an

individual could temporarily hold money but since the spending only transfers

it to someone else, there is always some money held by all of them together –

some part in the form of currency and some in the form of bank deposits. Such holding of money in the process of

spending it must be distinguished from money that is hoarded and withdrawn from

making purchases.

of income generated, the use of money involves it continuously changing hands –

passing from one party to another every time there is a transaction. This

movement of money from one hand to another happens recurrently and every unit of

money is used repeatedly in several transactions. What someone receives as

money is what another spends or lends and what anyone spends is what has been

received from sale or borrowing. In between receiving and spending, an

individual could temporarily hold money but since the spending only transfers

it to someone else, there is always some money held by all of them together –

some part in the form of currency and some in the form of bank deposits. Such holding of money in the process of

spending it must be distinguished from money that is hoarded and withdrawn from

making purchases.

Any income earner therefore recurrently receives an income

in the form of money but also keeps using that money in purchases in the

process of ‘spending’ the income. Some part is spent on acquiring the means of

consumption and any income so spent then cannot remain with the recipient of

that income in the form of money. The rest of the income that is ‘saved’ is

also not unspent. It can be spent by the income earner to acquire products that

add to his or her existing stock of real assets. Such savings in physical assets

in any period or increase in the stock of real products held by anyone can also

take place through accumulation of inventories of products produced and not yet

sold (which if they become unusually large would signify a problem unless they

are the specific products which their potential sellers wish to

accumulate). Alternatively, the ‘money’

can be temporarily transferred to others who will spend it on products, either

directly or through intermediaries. In the process, the saving of some takes

the form of financial savings – the acquisition of financial assets or

claims on others or their promises to pay. Even savings held in the form of

‘money’ are such financial savings. Against what is held in the form of bank

deposits by some there is also credit provided by banks to others. Currency is

also a promise to pay – a liability of its producers. Since everyone else in

the economy only receives currency when someone else uses it in a transaction,

their total holding of currency cannot increase unless the producers of such

currency, in our case the Government and the RBI, increase its availability by

using additional currency for their buying from or lending to others.

in the form of money but also keeps using that money in purchases in the

process of ‘spending’ the income. Some part is spent on acquiring the means of

consumption and any income so spent then cannot remain with the recipient of

that income in the form of money. The rest of the income that is ‘saved’ is

also not unspent. It can be spent by the income earner to acquire products that

add to his or her existing stock of real assets. Such savings in physical assets

in any period or increase in the stock of real products held by anyone can also

take place through accumulation of inventories of products produced and not yet

sold (which if they become unusually large would signify a problem unless they

are the specific products which their potential sellers wish to

accumulate). Alternatively, the ‘money’

can be temporarily transferred to others who will spend it on products, either

directly or through intermediaries. In the process, the saving of some takes

the form of financial savings – the acquisition of financial assets or

claims on others or their promises to pay. Even savings held in the form of

‘money’ are such financial savings. Against what is held in the form of bank

deposits by some there is also credit provided by banks to others. Currency is

also a promise to pay – a liability of its producers. Since everyone else in

the economy only receives currency when someone else uses it in a transaction,

their total holding of currency cannot increase unless the producers of such

currency, in our case the Government and the RBI, increase its availability by

using additional currency for their buying from or lending to others.

Individual income earners through their savings in physical

form or financial savings in every period accumulate or increase their wealth.

In the normal course, currency tends to be the least preferred form of holding

wealth – it does not earn the interest that even a bank deposit would and its

value depreciates if there is inflation while that of real and financial assets

can appreciate. Some real assets (like

property that can be given out on rent or assets that can be used in

production) can even generate an ‘income’ over and above the value expended in

acquiring and preserving them. Indeed, all income other than from ‘working’ –

for others in exchange for a wage or salary or in self-employment – is earned

by ownership of assets. Thus, even for those whose end objective is

accumulating ‘money’, stocking up currency doesn’t make sense except under

conditions where every other alternative asset is expected to depreciate or

offer no return – which would be when the economy is experiencing deflation and

depression. Otherwise, savings taking the form of increase in holding of

currency would be simply a reflection of increased holding of money for

transactions as the value of transactions increases over time. This applies to

black income earners as much as to others.

form or financial savings in every period accumulate or increase their wealth.

In the normal course, currency tends to be the least preferred form of holding

wealth – it does not earn the interest that even a bank deposit would and its

value depreciates if there is inflation while that of real and financial assets

can appreciate. Some real assets (like

property that can be given out on rent or assets that can be used in

production) can even generate an ‘income’ over and above the value expended in

acquiring and preserving them. Indeed, all income other than from ‘working’ –

for others in exchange for a wage or salary or in self-employment – is earned

by ownership of assets. Thus, even for those whose end objective is

accumulating ‘money’, stocking up currency doesn’t make sense except under

conditions where every other alternative asset is expected to depreciate or

offer no return – which would be when the economy is experiencing deflation and

depression. Otherwise, savings taking the form of increase in holding of

currency would be simply a reflection of increased holding of money for

transactions as the value of transactions increases over time. This applies to

black income earners as much as to others.

II

The National Accounts Statistics (NAS) is the source for

data on India’s

national income, consumption and savings which are estimated for every year by

the Central Statistical Organization (CSO). The data on the currency in

circulation is provided on a regular basis by the Reserve Bank of India (RBI).

data on India’s

national income, consumption and savings which are estimated for every year by

the Central Statistical Organization (CSO). The data on the currency in

circulation is provided on a regular basis by the Reserve Bank of India (RBI).

In the Indian economy, the production units which generate

the income captured in the national income are diverse in nature. A standard

classification in the NAS separates them into three institutional sectors – public,

private corporate (financial and non-financial) and household. The household

sector is itself a diverse category. It includes all producing units that are

not part of the other two sectors – which means almost all of agriculture, all

unregistered enterprises and self-employed producers of goods and services in

other sectors including the individual providers of personal services. However,

the incomes of households need not come only from that which is generated in

such production units. It can also come from the production activity in the

other two sectors. For example, the salary received by a government employee,

the wages received by workers in most registered factories, or the dividend and

interest earned by individuals against holding of shares and debentures of

companies are all sources of household income.

In fact, all the national income, barring a part (not taxes) earned by

the government or the profits retained by companies and the direct taxes paid by them, accrues to the household

sector as their personal (or household) income (which also includes net transfers

from other parts of the world). After the deduction of the direct taxes paid by

households, what is left is their personal disposable income which is what they

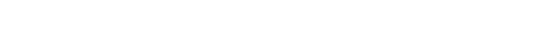

can either consume or save. As can be seen from Table 1, the current picture of

the Indian economy is that personal income or the personal disposable income of

households is significantly larger than the income generated within the

household sector (its Net Domestic Product) and accounts for most of the

national income. Of course, the distribution of this income is highly skewed

across households.

the income captured in the national income are diverse in nature. A standard

classification in the NAS separates them into three institutional sectors – public,

private corporate (financial and non-financial) and household. The household

sector is itself a diverse category. It includes all producing units that are

not part of the other two sectors – which means almost all of agriculture, all

unregistered enterprises and self-employed producers of goods and services in

other sectors including the individual providers of personal services. However,

the incomes of households need not come only from that which is generated in

such production units. It can also come from the production activity in the

other two sectors. For example, the salary received by a government employee,

the wages received by workers in most registered factories, or the dividend and

interest earned by individuals against holding of shares and debentures of

companies are all sources of household income.

In fact, all the national income, barring a part (not taxes) earned by

the government or the profits retained by companies and the direct taxes paid by them, accrues to the household

sector as their personal (or household) income (which also includes net transfers

from other parts of the world). After the deduction of the direct taxes paid by

households, what is left is their personal disposable income which is what they

can either consume or save. As can be seen from Table 1, the current picture of

the Indian economy is that personal income or the personal disposable income of

households is significantly larger than the income generated within the

household sector (its Net Domestic Product) and accounts for most of the

national income. Of course, the distribution of this income is highly skewed

across households.

Table 1: Household Sector Net Domestic Product

and Income as Percentages of Net National Income in India, 2011-12 to 2014-15

and Income as Percentages of Net National Income in India, 2011-12 to 2014-15

Let us take it that all the black income ultimately accrues

to some households and is part of their personal income. Let us also assume

that all the ‘currency with the public’, which is the currency in circulation minus the cash reserves of banks, is

held by such households. ‘Public’, however, has a wider meaning for the RBI –

and includes within it private corporate units which are not banks and the rest

of the world. Thus, currency held by households must be always less than that

held by the public but usually is a large part of it.

to some households and is part of their personal income. Let us also assume

that all the ‘currency with the public’, which is the currency in circulation minus the cash reserves of banks, is

held by such households. ‘Public’, however, has a wider meaning for the RBI –

and includes within it private corporate units which are not banks and the rest

of the world. Thus, currency held by households must be always less than that

held by the public but usually is a large part of it.

Incomes, black and white, are of course generated every

year. Let us assume to start with that most of the black incomes are not spent

but hoarded and accumulated in the form of currency. If that were to be the

case, however, the total black income earned over several years must on 8

November 2016 have been only a small part of one year’s national income. This

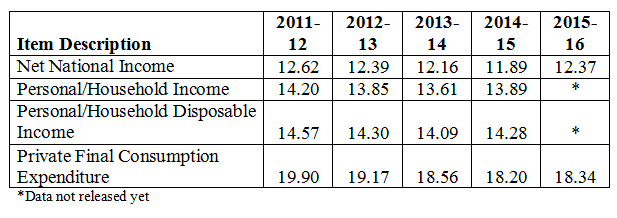

would be clear from Table 2 which shows for the five years preceding the

current one the percentage of currency held by the public at a date in November

of the respective years to the different income and expenditure aggregates for

the same years. We can see that relative to annual income and consumption

expenditure of all households, the amount of currency they held in November in

each of the last 5 years was only a small fraction.

year. Let us assume to start with that most of the black incomes are not spent

but hoarded and accumulated in the form of currency. If that were to be the

case, however, the total black income earned over several years must on 8

November 2016 have been only a small part of one year’s national income. This

would be clear from Table 2 which shows for the five years preceding the

current one the percentage of currency held by the public at a date in November

of the respective years to the different income and expenditure aggregates for

the same years. We can see that relative to annual income and consumption

expenditure of all households, the amount of currency they held in November in

each of the last 5 years was only a small fraction.

Table 2: Currency with the Public in

November of Respective Year as a Percentage of Income and Expenditure

Aggregates in India,

2011-12 to 2015-16.

November of Respective Year as a Percentage of Income and Expenditure

Aggregates in India,

2011-12 to 2015-16.

All income is of course not black but then neither is all holding

of currency. In other words, if one insists that a large part of the black

income is held in the form of cash, then one would also have to say that the

proportion of black income in the economy is small. For example, suppose that

half the black incomes generated over 5 years were to be held in the form of

currency and make up half the total currency holding by the public at any time.

Since that currency holding is at best 6-6.5 per cent of a year’s national

income then the annual black income generated would not even be 2 per cent of

the national income. If such an absurdly low figure is to be dismissed, one

must accept that like in the case of every other income earner, the currency

held by black-income earners at any point of time is only a small fraction of

their annual income.

of currency. In other words, if one insists that a large part of the black

income is held in the form of cash, then one would also have to say that the

proportion of black income in the economy is small. For example, suppose that

half the black incomes generated over 5 years were to be held in the form of

currency and make up half the total currency holding by the public at any time.

Since that currency holding is at best 6-6.5 per cent of a year’s national

income then the annual black income generated would not even be 2 per cent of

the national income. If such an absurdly low figure is to be dismissed, one

must accept that like in the case of every other income earner, the currency

held by black-income earners at any point of time is only a small fraction of

their annual income.

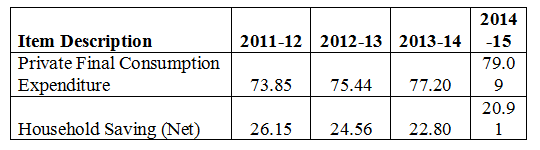

What is indicated by Table 2 and confirmed by Table 3 is

that most of the disposable income received by households every year is

consumed (this is what constitutes private final consumption expenditure) and

only a smaller part is saved.

that most of the disposable income received by households every year is

consumed (this is what constitutes private final consumption expenditure) and

only a smaller part is saved.

Table 3: Distribution of Household

Disposable Income between Consumption and Saving in India, 2011-12 to 2014-15 (Percentage

Shares

Disposable Income between Consumption and Saving in India, 2011-12 to 2014-15 (Percentage

Shares

Obviously even if it is originally received in the form of

currency, income that is consumed cannot be remaining in the hands of their

recipients as currency hoards – only the savings can take that form. Thus, an

assertion that large part of black income earned is hoarded in the form of

currency amounts to saying that consumption out of black incomes is low and

then further a large part of the saving takes that specific form. Let us see where this takes us by examining

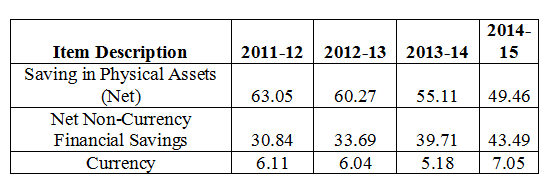

the importance of currency in savings of households. Table 4 shows the

distribution of the savings of all households in the latest four successive

years for which data are available.

currency, income that is consumed cannot be remaining in the hands of their

recipients as currency hoards – only the savings can take that form. Thus, an

assertion that large part of black income earned is hoarded in the form of

currency amounts to saying that consumption out of black incomes is low and

then further a large part of the saving takes that specific form. Let us see where this takes us by examining

the importance of currency in savings of households. Table 4 shows the

distribution of the savings of all households in the latest four successive

years for which data are available.

Table 4: Distribution of Net Savings of

Households in India,

2011-12 to 2014-15 (Percentage Shares)

Households in India,

2011-12 to 2014-15 (Percentage Shares)

Note: 1. Net

savings in physical assets (including valuables) is arrived at after deducting

the value of the depreciation or wear and tear of such assets; 2. Net

Non-Currency Financial Savings is the difference between increase in all

non-currency financial assets (bank and other deposits, investments in shares

and debentures, life insurance premium paid, contributions to provident and

pension funds, etc.) minus the increase in financial liabilities (borrowings

from banks and other institutions) over the same period for all households.

savings in physical assets (including valuables) is arrived at after deducting

the value of the depreciation or wear and tear of such assets; 2. Net

Non-Currency Financial Savings is the difference between increase in all

non-currency financial assets (bank and other deposits, investments in shares

and debentures, life insurance premium paid, contributions to provident and

pension funds, etc.) minus the increase in financial liabilities (borrowings

from banks and other institutions) over the same period for all households.

Clearly a large part of savings in India by households take

the form of increase in their stock of physical assets and increase in the

stock of currency holding constitutes a small part of even the financial

savings. Since it is the net saving every year that results in the increase in

the wealth of households, their total wealth at present is the aggregate effect

of such past savings. It follows then from the figures seen in Table 4 that in

the total current wealth of all households in India, less than 7 per cent would

be in the form of currency – and the reason why it should be so low have been

explained earlier. In other words, if Rs. 17 lakh crores was the value of

currency held by the public on 8 November, Rs. 243 lakh crores would have been

the minimum value of the non-currency wealth of households. Even this is a

gross underestimation because, as mentioned earlier, unlike currency whose

value declines with inflation, the money value of real assets and even

financial assets tends to increase over time.

We also do know that the value of bank deposits alone of households

(which account for a little over half their financial savings) at the end of

March 2015, more than a year ago, had a value of Rs. 54 lakh crores while the

net value of their physical assets (the Net Capital Stock in the NAS) at the

same time was over Rs. 142 lakh crores. The currency with the public at the

same time was under Rs. 14 lakh crores. Thus it is clear that if a large part

of black wealth is held in the form of currency, it must necessarily be a very

small part of the total wealth of all households (and we have not here even

included the black assets held abroad). If we again assume that half the black

wealth is in the form of currency and accounts for half the currency holding,

the total black wealth would be under 7 per cent of all

household wealth. If that is too low a figure to be accepted then it must be

the case that most of the black wealth is held in forms other than

currency.

the form of increase in their stock of physical assets and increase in the

stock of currency holding constitutes a small part of even the financial

savings. Since it is the net saving every year that results in the increase in

the wealth of households, their total wealth at present is the aggregate effect

of such past savings. It follows then from the figures seen in Table 4 that in

the total current wealth of all households in India, less than 7 per cent would

be in the form of currency – and the reason why it should be so low have been

explained earlier. In other words, if Rs. 17 lakh crores was the value of

currency held by the public on 8 November, Rs. 243 lakh crores would have been

the minimum value of the non-currency wealth of households. Even this is a

gross underestimation because, as mentioned earlier, unlike currency whose

value declines with inflation, the money value of real assets and even

financial assets tends to increase over time.

We also do know that the value of bank deposits alone of households

(which account for a little over half their financial savings) at the end of

March 2015, more than a year ago, had a value of Rs. 54 lakh crores while the

net value of their physical assets (the Net Capital Stock in the NAS) at the

same time was over Rs. 142 lakh crores. The currency with the public at the

same time was under Rs. 14 lakh crores. Thus it is clear that if a large part

of black wealth is held in the form of currency, it must necessarily be a very

small part of the total wealth of all households (and we have not here even

included the black assets held abroad). If we again assume that half the black

wealth is in the form of currency and accounts for half the currency holding,

the total black wealth would be under 7 per cent of all

household wealth. If that is too low a figure to be accepted then it must be

the case that most of the black wealth is held in forms other than

currency.

III

It bears reiterating that what has been shown here is that if

one argues that black incomes and black wealth constitute a large share of the

total income and wealth in the Indian economy then it must be true that the

holding of currency by the beneficiaries would have to be a small fraction of

their annual income and accumulated wealth. If one, however, wants to insist

that these ratios are very high for black income earners then it would have to

be accepted that the share of black income and black wealth in the economy is

very low. You can take your pick between the two but you can’t say that the

inability to convert currency after the sudden demonetization will destroy a

large quantity of wealth in the economy which is black or force a large black

wealth and income to be revealed – unless of course logic, reason and facts are

all set aside in preference for blind faith. It’s elementary, as Sherlock

Holmes would say – except that in this case you don’t need the intellect of a

Holmes to understand what is obvious from looking at the numbers.

one argues that black incomes and black wealth constitute a large share of the

total income and wealth in the Indian economy then it must be true that the

holding of currency by the beneficiaries would have to be a small fraction of

their annual income and accumulated wealth. If one, however, wants to insist

that these ratios are very high for black income earners then it would have to

be accepted that the share of black income and black wealth in the economy is

very low. You can take your pick between the two but you can’t say that the

inability to convert currency after the sudden demonetization will destroy a

large quantity of wealth in the economy which is black or force a large black

wealth and income to be revealed – unless of course logic, reason and facts are

all set aside in preference for blind faith. It’s elementary, as Sherlock

Holmes would say – except that in this case you don’t need the intellect of a

Holmes to understand what is obvious from looking at the numbers.

Indeed, if black income recipients had year after year been

just hoarding currency rather than spending it then the disruptive effects we

are seeing in the economy since 8 November would have been its permanent

feature. Such hoarding of currency would have meant its withdrawal from

purchases, which is precisely the result produced by the demonetization

decision which in effect has resulted in a forced hoarding of currency on a

mass scale. The damage to the economy caused by the black economy has thus been

compounded rather than rectified by demonetization.

just hoarding currency rather than spending it then the disruptive effects we

are seeing in the economy since 8 November would have been its permanent

feature. Such hoarding of currency would have meant its withdrawal from

purchases, which is precisely the result produced by the demonetization

decision which in effect has resulted in a forced hoarding of currency on a

mass scale. The damage to the economy caused by the black economy has thus been

compounded rather than rectified by demonetization.

We do now also know from the RBI’s own admission that

between 10 November and 5 December, Rs. 11.55 lakh crores of the 14. 75 or 14.8

lakh crores of currency notes held by the public and invalidated from 9

November has been already deposited with banks. That leaves only about 21-22 %

of the original value still with the public with half the period allowed for

depositing remaining. This would suggest that the black wealth and income that could

be extinguished may be even smaller than indicated by the illustrations given earlier.

On the other hand, the value of valid banknotes issued to the public by banks

over the counter or through ATMS till 7 December was still under Rs. 4.28 lakh

crores – 10.5 lakh crores less than the currency rendered invalid. If replacing

4.28 crores of the total 14.8 lakh crores of invalidated currency took 29 days

(from 9 November to 7 December), and that too with largely Rs. 2000 notes, how

long will replacing the remaining Rs. 10.5 lakh cores take? The simple

calculation is another 71 days at the same rate. However, keeping in mind that

there was already some stock of printed new notes on 8 November and that the

number of units of lower denomination currency required to get the same value

will be larger, the time required for replacing the remaining currency would be

even greater. The cash crunch therefore will continue for a prolonged period

and this was only to be expected – the currency that needs to be replaced was

printed over several years and gradually added to the stock of currency in

circulation and now the same printing capacity must produce that total amount

in a shorter time and there are limits to such shortening.

between 10 November and 5 December, Rs. 11.55 lakh crores of the 14. 75 or 14.8

lakh crores of currency notes held by the public and invalidated from 9

November has been already deposited with banks. That leaves only about 21-22 %

of the original value still with the public with half the period allowed for

depositing remaining. This would suggest that the black wealth and income that could

be extinguished may be even smaller than indicated by the illustrations given earlier.

On the other hand, the value of valid banknotes issued to the public by banks

over the counter or through ATMS till 7 December was still under Rs. 4.28 lakh

crores – 10.5 lakh crores less than the currency rendered invalid. If replacing

4.28 crores of the total 14.8 lakh crores of invalidated currency took 29 days

(from 9 November to 7 December), and that too with largely Rs. 2000 notes, how

long will replacing the remaining Rs. 10.5 lakh cores take? The simple

calculation is another 71 days at the same rate. However, keeping in mind that

there was already some stock of printed new notes on 8 November and that the

number of units of lower denomination currency required to get the same value

will be larger, the time required for replacing the remaining currency would be

even greater. The cash crunch therefore will continue for a prolonged period

and this was only to be expected – the currency that needs to be replaced was

printed over several years and gradually added to the stock of currency in

circulation and now the same printing capacity must produce that total amount

in a shorter time and there are limits to such shortening.

Thus, with the passage of time, demonetization is looking

more and more like lots of pain for little gain. But then, was it ever truly about

vanquishing the black economy?

more and more like lots of pain for little gain. But then, was it ever truly about

vanquishing the black economy?

Surajit Mazumdar is a Professor of Economics at Jawaharlal Nehru University.