Surajit Das

Growth rates of the national income are likely to be badly affected following the Coronavirus lockdowns in many countries including India. There would be a rise in unemployment and poverty unless the government helps in revival of the economy. If the purchasing power of vast majority of the population comes down, the aggregate private consumption expenditure would come down drastically. If the aggregate demand in the market falls, the aggregate supply would also come down in ex-post situation. The expected rate of profit would fall and the aggregate investment demand would also reduce as proportion of GDP. Increase in net export would not be able to revive the economy because Coronavirus led depression is a global phenomenon. Therefore, the fourth component of GDP i.e. the aggregate government expenditure is the last resort to revive the aggregate demand in the economy.

.

To understand the extent to which the Indian economy is likely to shrink, let us look at the numbers provided by the central statistical office (CSO) of Govt. of India. According to the second advanced estimate, the GDP at current prices for the year 2019-20 has been expected to be Rs.204 lakh crore. The private final consumption is around Rs.123 lakh crore, the government final consumption expenditure is Rs.24 lakh crore, the aggregate investment (including change in stocks and valuables) is Rs.61.5 lakh crore, export is Rs.38 lakh crore and import is Rs.43.5 lakh crore. There is a statistical discrepancy of Rs.1 lakh crore. So, the private consumption is 60.2%, government consumption is 11.8%, investment is 30.3%, export is 18.7%, import is 21.4% and discrepancy is 0.5% of total GDP of 2019-20 in India.

.

If we forget seasonal variation in GDP for simplicity and calculate the GDP for 40 days, it is likely to be Rs.22.5 lakh crore. There has been some private consumption and government consumption during the lockdown. Even if we assume the government consumption to remain unaffected and private consumption expenditure to be one third during the lockdown period, the total consumption expenditure would be around Rs.6.5 lakh crore in 40 days. Therefore, the private consumption is assumed to fall by Rs.9 lakh crore. Addition to the stock of capital or investment is unlikely to take place during the lockdown. Therefore, the investment demand would fall by at least Rs.6.75 lakh crore. Let us assume that the trade deficit remains the same during these 40 days (both export and import may have come down). Therefore, the net loss in GDP due to lockdown would be in the tune of Rs.16 lakh crore or so. This is equivalent to 8% of the current GDP of India.

.

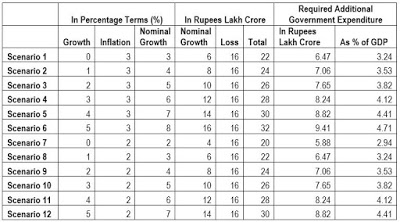

If we consider data on GDP at current prices and the combined government expenditure of central and the state governments during 1990-91 to 2018-19, we see that the government expenditure elasticity to be 0.96 (by taking logarithms of both the series and running Cochrane-Orcutt Paris-Winsten bivariate log-linear Regression), given the structure of Indian economy and the composition of aggregate government expenditure. The aggregate government expenditure to GDP ratio in 2018-19 has been estimated to be 28.2% in India. Therefore, the government expenditure multiplier would be equal to 3.4 i.e. if the government spends Rs.1 lakh crore extra, the GDP is expected to increase by 3.4 lakh crore. If we assume two inflation scenarios of 3% and 2% per annum and 6 growth scenarios from 0% to 5% growth in 2020-21, then the requirement of additional government expenditures can be worked out as follows.

.

Estimated Additional Government Expenditure Requirements

Note: Author’s calculations based on the estimation of fiscal multiplier in India.

.

Clearly, the government has to spend at least 3% of GDP additionally in order to achieve 0% growth with 2% inflation. If we consider the expected inflation rate to be 3%, then the additional expenditure requirement would be 2.25% of GDP or Rs.6.5 lakh crore (scenario 1) in order to ensure non-negative growth in the country. To achieve 5% growth in 2020-21, under the 3% inflation assumption, the government has to spend 4.7% of GDP or Rs.9.4 lakh crore extra (scenario 6). If the inflation rate comes down to 2% in 2020-21, the extra expenditure requirement would be 4.4% of GDP or Rs.8.8 lakh crore (scenario 12). If the government announces 5% of GDP (i.e. Rs.10 lakh crore) worth of stimulus package, it should be possible to achieve 9% nominal growth (either 5% growth and 4% inflation or 6% growth under 3% inflation) in India in 2020-21. It is important to mention here that the developed countries have already announced packages worth of 21% of GDP in Japan, 11% of GDP in the US, 9.9% in Australia, 8.4% in Canada, 6.5% in Brazil and so on and so forth (see chart).

.

There would definitely be a revenue shortfall due to lockdown and economic depression. Therefore, if the government goes for necessary expansionary fiscal policy as mentioned above to revive the economy, the combined fiscal deficit would rise by 4-5% of GDP in the current fiscal year. Whether the commercial banks would be willing to lend the government that much amount of money would really depend on the credit-deposit ratio of the banks. After lockdown, the demand for credit would come down due to reduction in investment demand and the deposits would also come down because of lower income of people at the aggregate level. The rest of the money can be borrowed from the central bank (RBI) to finance the additional fiscal deficit. The central bank may wish to lend 4-5% of GDP amount of money to the government at a discounted rate to combat the coronavirus challenge instead of just tinkering with the reserve ratios and the repo rates. The RBI is sitting on a foreign exchange reserve worth of Rs.36.7 lakh crore (18% of GDP, 480 Billion US$) as on 24th April 2020. Monetisation in the tune of 5% of GDP or Rs.10 lakh crore is perfectly possible for the RBI at this hour to revive the growth for maintaining the aggregate level of employment in the economy. There is no possibility of demand pulled inflation under a situation of demand deflation – the international oil price has also hit the historic low because of the pandemic. Our total import bill of 6 months is less than 11% of GDP. Even if there is a risk of some capital flight, the government can always borrow 5% of GDP from the RBI. Higher fiscal deficit may lower India’s rating but, lower growth also would do the same. Higher level of unemployment would cause misery in the country and lower the future investment and growth rate and revenue earning even further. We would be entering into a vicious cycle if the government does not give the fiscal boost now.

.

The government should spend this additional money not only on health-related expenditures but also to compensate for peoples’ income loss due to 40-days long lockdown. It must go for cash transfer particularly to the poorer section of population. The compensation should be given at the state-wise minimum wage rates for agricultural workers in the rural areas (Rs.350 per day) and that of industrial workers in the urban areas (Rs.450 per day). This is essential not only for supporting the poor for their survival but, for keeping their purchasing power intact so that the aggregate demand can be maintained in the economy after lockdown gets over. The small and medium scale enterprises (SMEs) also should be supported to restart their business in full-fledged manner. The MGNREGS should be expanded to the urban areas also and the wage rate should be made equal to the minimum wage rates of agricultural labourers and industrial workers in the scheme. The education expenditure should be gradually increased from 3% to at least 5% of GDP. The combined government health expenditure as proportion of GDP in India is one of the lowest in the whole world (less than 1% of GDP excluding water supply and sanitation). The government also must try to increase this ratio to 3% of GDP as soon as possible. Since, these are primarily state subjects, more money should be given in the hands of the state governments. If the government does not increase its expenditure at least by 3% of GDP this year, we are likely to face a negative growth rate in India in the economic year 2020-21. This prediction is based on the assumption of 40 days long lockdown; the numbers would be higher in the present context of partial extension of it upto the 17th May.

The author is Assistant Professor at CESP, JNU, New Delhi