Vikas Rawal, Suvidya Patel, Jesim Pais

Vikas Rawal, Suvidya Patel, Jesim Pais

While the country is grappling with the COVID-19 pandemic and the economy is in doldrums, the central government, instead of taking measures to provide immediate relief to the distressed population, has used the opportunity to introduce sweeping changes in the regulatory framework of the agricultural marketing system of the country. On June 3, 2020, the Cabinet approved three ordinances. These ordinances were converted into Acts after they were passed, under controversial circumstances and despite stiff resistance of almost all the opposition parties, in the Monsoon session of the parliament.

This article provides a critical assessment of the likely impact of the Farming Produce Trade and Commerce (Promotion and Facilitation) Act, 2020 (FPTCA). It has been argued by the government that this Act will lead to transparent and barrier-free trade of agricultural produce and the emergence of alternative private marketing channels will result in better price realisation for farmers’ produce.

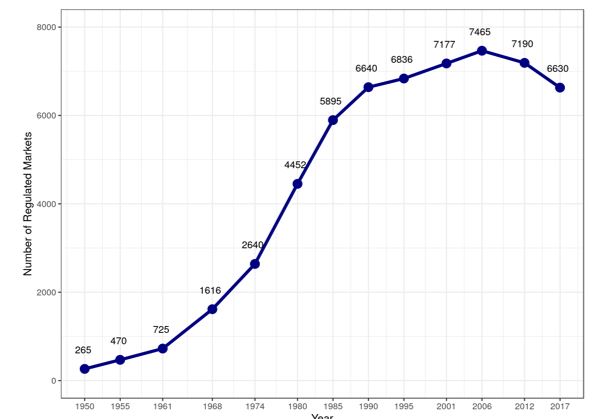

The system of regulated markets, introduced first in India in the 1930s, was expanded to almost all the States after Independence to protect farmers from exploitation by traders, to ensure that they received remunerative prices, and to ensure that they received timely payments for their produce. Since agricultural marketing was a State subject under the Constitution of India, the APMC Acts were passed by the States. The network of regulated markets expanded greatly in the 1970s and 1980s (Figure 1).

Although there is considerable diversity in provisions of the APMC Acts of different States, broadly speaking, the APMC Acts of most States specify that the sale and purchase of notified agricultural commodities should be carried out in the market yards (mandis) established/notified by the government. The APMC Acts mandate that prices in the mandis be determined through open auctions or closed tendering. Market fees, commission rates, and other charges for various agencies are specified by the Acts and have to be imposed uniformly on all trade without discrimination. Payments to the farmers have to be made within a specified time frame. These markets are managed by the Market Committees which consist of representatives of farmers, traders, warehousing entities, and administration officials. The Market Committees form rules to prevent malpractices in buying produce from farmers. In case of any grievances, the farmers have the option to complain to the Market Committees for dispute settlement. The State governments, and the State Agricultural Marketing Boards, are responsible for supervising the functioning of these regulated markets.

Although the APMC regulations were designed to safeguard the interests of the farmers, the actual implementation of these regulations has remained far from ideal and several problems in the functioning of the APMC markets persist. It has been found that commission agents and Marketing Committee members often form cartels and collude to manipulate prices. Given the inadequacy of formal-sector credit, particularly for small peasants, it is common for the traders and commission agents to provide credit to farmers and tie crop sales with repayment of credit, charging a high rate of interest from the farmers.

An important failure of state intervention in agricultural marketing has been that no serious attempt has been made to make agricultural markets accessible to women farmers. Despite a considerable degree of feminisation of agricultural production, marketing of produce remains a domain where men dominate. State-regulated markets remain male-dominated spaces in most parts of India. Women are hired as labourers in the mandis — for tasks such as cleaning, winnowing and packing — but are seldom seen participating in trade, either as peasants or as traders.

Deregulation of Agricultural Markets

Deregulation of agricultural markets has been a part of the central government’s agenda for some time now. The case for liberalisation of agricultural marketing rests on mainly two arguments: first, that liberalisation would result in increased competition which, in turn, will result in better price realisation for farmers, and secondly, that liberalisation will result in an increase in investment, from the private sector, in agricultural marketing.

The earliest proposal for liberalisation of agricultural marketing was prepared by the Shankerlal Guru Committee in 2001. The Guru Committee also recommended that the Essential Commodities Act (1955) be ‘repealed’. Taking the process further, the then NDA government drafted a model State Agricultural Produce Marketing (Development & Regulation) Act in 2003 which allowed various alternate private marketing channels in agricultural marketing.

The agenda to push the States to reform their APMC Acts took a backseat, though it was not abandoned completely, after the BJP-led NDA lost elections and the Congress-led UPA came to power in 2004. Many States amended their APMC Acts over the years to simplify the rules as well as to allow greater participation of the private sector. The most drastic change was introduced in Bihar where the State APMC Act was repealed in 2006. Several States introduced provisions that allowed direct purchases from farmers, allowed licensed traders to buy from all regulated markets in the States, eased processes for obtaining licenses to operate in regulated markets or introduced explicit provisions to allow for creation of marketing infrastructure by private-sector.

The project of liberalisation of agricultural marketing was pushed with renewed vigour at the national level after the BJP returned to power in 2014. In 2017, the central government came up with a new model Agricultural Produce and Livestock Marketing (Promotion and Facilitation) Act. In addition to the earlier provisions, the new model Act treated an entire state as a single market, included e-auction as part of auction mechanism and allowed third party assaying and grading certification. The new model Act allowed the warehouses and cold storage facilities as well to be declared as market areas.

Over the last few years, the central government has used various ways to coerce the State governments to amend their respective APMC Acts to liberalise agricultural markets.

In the terms of reference of the Fifteenth Finance Commission, the central government specifically asked it to consider using performance-based incentives for the provision of grants. Consequently, in its report for the year 2020-21, the Finance Commission introduced performance-based grants and recommended that the States that pass the model “Agricultural Marketing Produce and Livestock Marketing (Promotion and Facilitation) Act”, “Model Agricultural Produce and Livestock Contract Farming and Services (Promotion & Facilitation) Act” and the “Model Agricultural Land Leasing Act, 2016” in their legislatures would “become eligible to avail the grants awarded by us from 2021-22 onwards”.

This was an unusual recommendation. Although several Finance Commissions in the past have used developmental indicators to measure resource requirements of States, to facilitate them to take policy measures for development in the States, and more recently, to impose fiscal discipline on the States, there are not many precedents of Finance Commissions demanding specific legislative changes by States for them to become eligible for grants. The most important, and perhaps the first such case, was when the 13th Finance Commission made amendment/enactment of the FRBM Acts by States as a precondition to get the State-specific grants. But the Fifteenth Finance Commission went a step further, unprecedented in the history of Finance Commissions, to demand that States enact legislation in areas that were not directly related to State finances or fiscal discipline of the States.

Given this context, the decision to enact central laws, and that too by bringing ordinances while the Parliament was not in session, and without engaging in wider consultations with either the State governments, farmers or other sections of public, marked a significant change in the strategy of the central government. As per the Seventh Schedule of the Constitution, powers to make legislation related to agriculture are given only to the State governments. This is the reason that all laws related to agricultural marketing thus far have been State-level laws. Since the time the constitution was adopted, all States have had their own APMC Acts, which have been enacted and amended at different points of time, and vary considerably in terms of their provisions.

It is evident that the central government decided to use the opportunity provided by the COVID-19 pandemic to enact these laws. Not only has the enactment of the FPTCA (and the other two farm bills) undermined the legislative powers of State governments, various provisions in these Acts also undermine executive powers of the State governments. Barring registration of traders, the Act does not allow the State governments any possibility to intervene in agricultural trade under the Act to protect interests of farmers in the State. The State government can not impose any tax on the trade, regulate the trade in any way or intervene in dispute resolution.

Key Provisions of the FPTCA

The FPTCA aims to achieve deregulation of the agricultural marketing system through the following provisions.

As per the FPTCA, any area or location outside the physical boundaries of the market yards run by marketing committees or notified under the state APMC acts can be considered as a “trade area” and agricultural trade occurring in such trade areas is exempted from regulation under the state APMC Act. In other words, provisions of this Act supersede the definition of market areas around the market yards where agricultural trade can only take place under the provisions of the APMC Acts and rules formulated by the market committees.

The Act allows any trader the freedom to engage in intra-state or inter-state trade of agricultural produce with farmers or other traders for any purpose including wholesale trade, retail trade, export, processing and value addition.

Besides the direct engagement with the farmers, the Act allows the private traders to set up private market yards or electronic trading platforms to facilitate the trade and commerce of scheduled agricultural produce (the agricultural produce which is notified under state APMC Acts).

While Act provides for the possibility that the government may prescribe a system of electronic registration and the modalities of transaction later, the only requirement to trade specified in the Act is that the trader should have a Permanent Account Number allotted under the Income-tax act or any other such document that the government may notify.

The Act does not provide for any regulations for the process of price discovery between the buyer and the seller, and the price fixation is entirely left to mutual consent between the buyer and the seller. The Act prescribes that the payment to the farmers should be made on the day of delivery or within three days in certain conditions.

Would FPTCA improve price realisation of farmers?

Proponents of liberalisation of agricultural marketing have argued that regulations under the APMC Acts were the main cause of low price realisation of farmers as these regulations created entry barriers for buyers, caused fragmentation of markets and reduced competition.

Would liberalisation of agricultural marketing through the FPTCA result in better price realisation for farmers?

The prices farmers get are determined by the overall supply and demand conditions and, within the overall limits determined by the conditions of demand and supply, by the extent of concentration of market power in the supply chains and the position of individual farmers in the system of agrarian class relations.

At the macro-level, deregulation of input prices over the last three decades has resulted in a steady increase in cost of production, which has put an upward pressure on the MSP. On the other hand, increasing integration with the world market, large build up of public stocks of grain and economic slowdown have put a downward pressure on the open market prices. Consequently, in recent years, open market prices have been considerably lower than the MSP for a number of key crops. Given this, government procurement has become critical for returns from rice and wheat cultivation. On the other hand, low price realisation has become a widespread problem for crops and regions that are not covered by public procurement.

Concentration of market power further squeezes price realisation for small farmers within this overall macroeconomic context. It is because of concentration of market power and weak class position of small producers that traders and other agents can collude, engage in unfair practices and use various forms of interlocking to bring down the prices received by farmers.

Over the last few decades, the share of top, organised-sector agribusiness companies in the volumes they acquire, process and supply to consumers has steadily increased because of economies of scale, because of ending the reservations of various activities for many agro-processing industries for small scale units and various advantages provided by the government during the period of neoliberal reforms. Market concentration in the supply chains puts a downward pressure on producer prices, and increasing competition in the first level of trade — between farmers and the lowest rung of traders (many of whom are effectively simply agents of agribusiness companies) — can only mitigate downward pressure on producer prices to a small extent. The increasing penetration of agribusiness companies in agricultural marketing is likely to increase the concentration in the supply chains and is likely to put downward pressure on producer prices rather than result in better price realisation for farmers. In other words, greater control of large agribusiness companies could reduce competition rather than increase it.

The APMC Acts typically mandate that the produce be sold through open auctions or a system of closed bids. The FPTCA does not specify any such mechanism to be followed in trading areas, and the prices are to be solely determined by mutual agreement between a buyer and a seller. It is expected that, given tax advantages offered by FPTCA, private traders would shift to trading outside the APMC markets, and over time the auctions at the APMC markets could cease to be relevant for price discovery.

The FPTCA also does not specify regulations for ensuring that farmers are not duped through unfair practices like use of non-standard weighing systems or through the imposition of excessive charges for various services. The dispute settlement mechanism specified in the Act would also work against the farmers as critical powers have been provided to the bureaucracy while elected representatives (in local bodies or State legislature) or organisations of farmers have no role. The disputes related to trade under the FPTCA cannot be challenged in the civil courts while higher judiciary will be beyond the reach of most farmers.

There is no empirical evidence to suggest that farmers in the States that have liberalised their trade more have better price realisation than farmers in other States. In fact, given the role of public procurement in price realisation, the empirical evidence would suggest that, for rice and wheat, public procurement and not liberalisation of agricultural marketing system is the key determinant of price realisation by farmers.

Would FPTCA result in greater investment in agricultural marketing infrastructure?

It has been argued by proponents of liberalisation of agricultural marketing that restrictions imposed by the APMC Acts have discouraged private investment. The natural question that follows then is whether the FPTCA is likely to result in an increase in investment in agricultural marketing.

Following points in this context are noteworthy.

First, there has been a sharp deceleration in the public investment for creation of market infrastructure since the 1990s (Figure 1). In most States, APMC mandis are too few and far between. The Swaminathan Commission in 2004 recommended that a regulated market yard should be available for every 80 sq km. However, in reality, the all-India average of the area served by a regulated market is about 496 sq km. The density of regulated markets in no State is close to the benchmark recommended by the Swaminathan Commission.

Investment for creation of agricultural marketing infrastructure declined and not many new regulated markets were created after liberalisation of the economy started in 1991. In fact, the number of regulated markets has declined over the last 15 years (Figure 1).

Figure 1. Number of regulated markets in India

Source: 1. Plan Documents, Various Five Year Plans, Planning Commission

- Economic Survey, 1996-97

- Directorate of Marketing & Inspection

- Central Statistics Office (2010), Manual of Agricultural Prices and Marketing

It is highly likely that public investment in creating new APMC markets and improving infrastructure of APMC markets will fall dramatically in the coming years because of the poor resource position of the central and State governments and the likely fall in revenues of Market Committees of the existing regulated markets.

Secondly, given the low density of regulated markets in many States, there was already plenty of scope for private corporate investment in development of agricultural marketing infrastructure. Despite this, the investment by private agribusiness corporations in development of agricultural market infrastructure has remained small. Little private investment has taken place in States that do not have APMC laws or have liberalised APMC laws considerably.

Would tax and other economic incentives provided under the FPTCA make investments in agricultural marketing more attractive and draw private corporate investors? There are at least two reasons why this might not turn out to be the case.

First, public and the private investment are complementary. Creation of basic infrastructure in the public sector results in downstream private sector investment in cold-storages, agro processing and retail. A decline in public investment could become a barrier for private corporate investment as well.

Secondly, an unprecedented economic crisis caused by the COVID pandemic (and reckless policies used to deal with it) is likely to result in a general slowing down of private investment. While world over countries are using public investment to rebuild the economies, relying on private investments for creating basic infrastructure in the current context does not seem to be a promising strategy.

To sum, it does not seem likely that FPTCA would create conditions for a significant rise in investment in agricultural marketing.

Impact on the system of procurement

Public procurement has become exceedingly important in recent years because returns from agriculture have been squeezed due to increasing cost of production and greater integration with the world markets. Deregulation of input markets and withdrawal of public provisioning of various services has been responsible for the increase in cost of production.

Public procurement is, however, limited primarily to rice and wheat. Government neither has infrastructure for storage nor an institutional structure for distribution of other commodities. Even in case of rice and wheat, there is a close relationship between the existence of market infrastructure and public procurement. In fact, the existence of regulated markets and procurement centres is a precondition for procurement. Government agencies carry out procurement in the market yards and in the special procurement centres established by the Market Committees and the State Marketing Boards. Farmers in States that do not have enough designated market yards or procurement centres do not have the option of selling grain to government agencies.

The FPTCA would create conditions in which maintenance, upkeep and modernization of regulated markets will become uneconomical and suffer because of lack of resources. There is no doubt that degeneration of the regulated market system will work to reduce the access of farmers to public procurement.

Concluding Remarks

If the FPTCA is not likely to result in an increase in investment in agricultural marketing and better price realisation for farmers, what should be the agenda of the government to ensure that these happen?

First, the problems of existing regulated markets — cartelization, use of unfair practices, interlocking of trade with provision of credit, and negligible participation of women — are rooted in lack of implementation of agrarian reforms and effective democratisation of the social, political and economic institutions in Indian villages. Failure of governance and ineffective regulation are an outcome of political dominance of big capitalists, merchants and landlords. The end to economic exploitation of peasantry can only be achieved through implementation of redistributive agrarian reforms and effective democratisation. These are critical to make the regulatory systems more effective. Farmers need more effective regulation, and not less regulation, in the arena of agricultural marketing.

Second, public investment for agricultural marketing has dried up since India adopted the economic reform programme in 1991. There is a massive shortage of market yards and procurement centres in most States. The need for technological modernisation of the agricultural markets has become ever greater in the post-COVID context. Expecting that the private sector can take the lead in creation of this basic infrastructure, particularly in a period when the economy is going through a severe crisis, is completely unrealistic. This basic infrastructure needs to be created through public-sector investment even for the private sector investments in downstream activities such as agro-processing and retail to become attractive.

Thirdly, inadequacy of formal sector credit is a key problem for the farmers. The problem of inadequacy of formal-sector credit for agriculture has intensified in the post-reform period and is particularly grave for tenants and other poor peasants. Debt relief has been a long-standing demand of the farmers. Providing debt relief and expanding availability of affordable formal-sector credit would ease their dependence on informal sources such as commission agents and traders.

Finally, making agriculture remunerative for farmers is a key challenge. This requires an overarching review of policy changes that have been introduced in the areas of input pricing, trade liberalisation and prices of agricultural produce as part of the liberalisation programme. These changes have been responsible for the deep agrarian crisis that rural India finds itself in today.

Vikas Rawal is Professor at CESP, JNU, New Delhi

Suvidya Patel is Research Scholar at CESP, JNU, New Delhi

Jesim Pais is Director of Society for Social and Economic Research (SSER), New Delhi